Retirement - The Rug Has Been Pulled

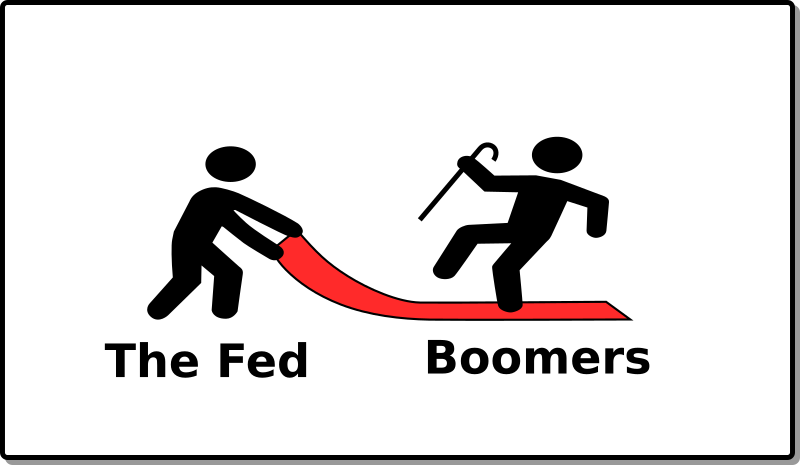

The path of invest in diverse portfolio of stocks and bonds, is dead. Those who have a retirement account that is mostly invested in the stock market will face a crash on three fronts that will wipe out everything they have accumulated.

The boomers who still believe the lie "your house is your largest asset" are going to watch, in horror, as their house "equity" disappears. (it never existed, but that is not how they will see it)

Rich people have moved their allocations out of the stock market, away from bonds, and into things like gold and bitcoin. This means there is nothing really left in the financial markets. It is hollowed out, and the house of cards is going to collapse… if it doesn't turn to dust first.

A few years ago i suggested that people move their retirement accounts into self directed IRA in gold or bitcoin. I probably even advised that you take the penalty and withdraw everything and put it all into bitcoin (at $10,000). Today i do not know what i would advise. So many paths are already cut off because the time has grown short. Tomorrow money flight laws go into effect.

This will affect everyone, but boomers do not have time to recover

There is no perfect plan here. Several things are happening from several different directions, and you will have to adjust to each.

Like, the stock market is going to have a CRASH! Like 50-70% crash.

But, also, the stock market is going to be closed because of fraud. Where, you will lose 100% of your stock, but then, may get some of it back.

However, they are probably going to pump the stock market to attract everyone in, just before the crash. So, if you just get out, you might lose out on a lot gains.

If you have free money, you should buy silver.

However, most retirement funds are in IRAs or 401ks or something else you cannot readily get out of. And so, you will be stuck with gold. You can get a self-directed IRA in which you buy gold (usually has to be in a vault) Another path is to buy gold mining stocks. (which has problems like the stock market crashing, but also, govern-cements may confiscate mines.

Mining stocks did ok during the big stock market crash.

You need bitcoin.

Again, most retirement funds cannot be directly invested in bitcoin, however you can put your account into bitcoin ETFs. I hate to say this, because you are going to lose. The ETFs have breaker switches which will not keep up with bitcoin price jumps. And the ETFs are set up to have their bitcoin yoinked under certain conditions. However, the bitcoin ETFs may make more wealth than anything else that you could put your tax-deferred funds into.

Most of the retirement funds will be found to be missing, due to one scam or another. Sooooo, it still may be better to get your money out of the funds, but can you do it in time? You can't go buy silver at most coin shops today.

House prices will probably go down 10% every year

From here on out, we have passed peak people. Now their will be more houses on the market than buyers.

Boomers moving out of their homes will start putting a lot more houses on the market. 25% of the houses will be put on the market this decade. Add to that the investors who will be dumping their inventory (Blackrock is already having trouble with people wanting to leave their REIT) Migrants leaving will add more to the housing inventory

This will see more and more inventory, and less and less buyers. I am unsure if it will crash like 2008. My gut feeling right now is that it will go down slower, but it will never stop going down. 10% drop per year will be the minimum i expect to see.

So, each year you hold onto your house, thinking it is your largest investment, is a tenth of your equity gone.

And, i really do mean that the downward movement of house prices will not stop.

We are going to see unCivil Wars in many cities. Which means more empty houses, and more houses that no one will want to live in. (price go to zero). Then you add natural and unnatural disasters, and we will see more people perishing, and more houses empty.

If you own a house, and you are thinking of downsizing or moving into a retirement home, make the sale as soon as possible. If you are an investor, you are already late to the party. Most people are taking 10% off their home price just to get buyers to start looking.

The monetary system reset

People of the future will be MUCH better off. Even if they lose everything in the stock market. You just have to live through all the shenanigans that we will have on the way to having real money.

Having 10,000 satoshis will put you in a better position than having a million dollars of fortune 500 stocks. The stocks will go to zero, and the satoshis will go to a point where one is not an insignificant amount of wealth.

Housing will no longer be such a huge part of your budget. There is a good chance that it will be free, or paid off when it is built. And you, and your 99 closest friends helped build it.

There will be many devices that will make continuous, non-polluting electricity. The utility bill will be a thing for the past.

Basically, you will make real money, that will simply increase in value over time (no fancy investments needed) while your monthly expenditures will go down lots.

So, those who live through this coming reset/rebuilding will be far better off, we just got to get there.

What do you do when your retirement fund has been stolen?

There isn't much you can do except hope Social inSecurity can cover things.

What do we do when everyone's retirement fund has been stolen?

Go on the warpath and find all those banksters, in their bunkers, and dig them out?

Great, fun times ahead! But it doesn't get back people's retirement accounts.

So many people have been trying to warn people of these coming financial shenanigans, but their warnings have largely gone unheard. Or worse, mocked. "Look, the stock market is still going up! My house's value is still going up! There is nothing to worry about"

I am unsure anyone has time to get their money out of the market (if it is in a tax-deferred account.) in time to save it.

Precious metals are already getting bought out. Calling around to coin shops gets a lot of "we're sold out", imagine trying to buy after a few months have passed while the administrators decide if they should release your money to you.

If you see this, and decide to sell your house right away, be prepared to chop the price. And then get bargained down. Zillow prices are behind the times, and are often lies. The only thing you can really see is the amount of listings that say, slashed $10,000…

Big changes are coming.

I don't plan to sell my mortgage free home, it is a home for my family as I see it and functions as a stabilizing foundation for my kids. It does have a legal Rental suite that I am currently a passive income from so I can write off a portion of my property, utility taxes and fees.

I remember an older Boomer friend who sank a lot of cash into her RRSP/IRA and how the 2008 crash wiped out half of her equity. I happened to configure my retirement savings into a defensive posture. She begged me for advice, I did take a look at her portfolio and I told her to be patient for about a year and it will recover. And it did recover only that she panicked and sold out before it did. 🙄 She could not stomach her portfolio's volatility and shouldn't have been in them to begin with. I believe her Advisor sold her the wrong Investments.

Time to pop some corn 🌽

Sounds like you are in a good position.

What i was complaining about is the average boomer, that i see, is in a 5 br, two story house, and the kids are gone. No rental suite, and an HOA.

And they tell me that they are sitting pretty because they have so much equity.

Homes are not liquid.

Anyway, single detached home values pushed a lot of people into condos, shoe boxes more like it, owners got soaked as most condos were not up to snuff in leaky water issues that became endemic in the whole industry. Now today, sales and prices are falling through the floor. Condo owners are rug pulled again in negative equity.

Thousands of unsold units remain, with more flooding the market.

Construction companies are going bankrupt.

I'm kind of keeping an eye out for a deal and getting a second revenue rental.

My home is actually a 5 BR two floor in the burbs well outside Vancouver.

I rent my lower floor out.

!LOL

That is neat that you were able to split the house floor by floor.

Most floor plans would never allow it.

But really, they should all be that way.

Having 5 bedrooms after the kids leave is silly, unless you have hobbies, like collecting yarn… i mean, knitting.